Sarah Rushing Scott and, by extension the wisdom from KW Wealth, joins us to walk us through the path of Creating a Solid Investment Plan and she’ll have some really helpful tools to share with us. We’ll also be touching the fundamentals of building a ‘war chest’, the path of money, real estate investment options, other investment options, and transitioning from owning a job to investing… and letting your money work for you.

One quick disclaimer here though… members of neither the Scott Property Group or Avenue Property Group are NOT financial advisors, CPA, tax advisors or tied to your individual finances.

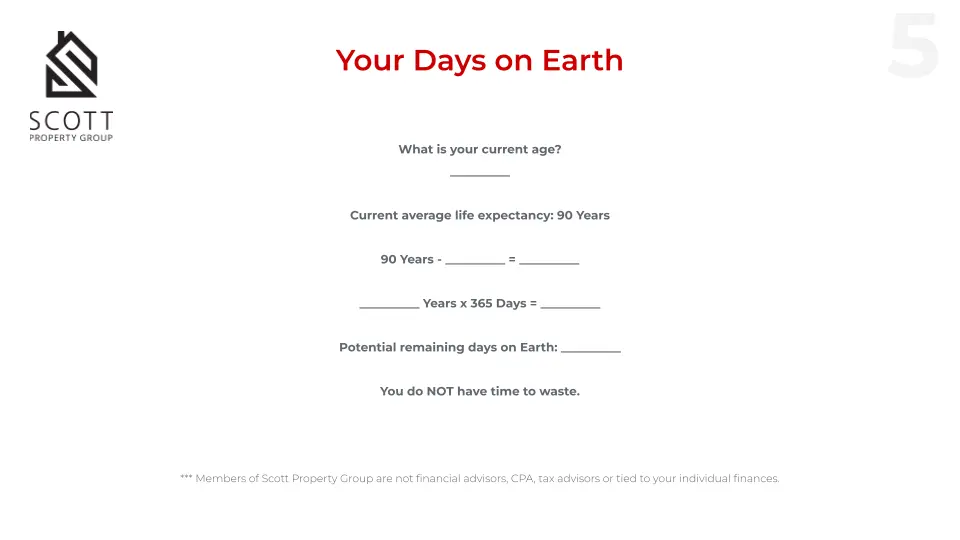

Your Days on Earth

One of the ideas shared by the kwWealth team is that building a plan, or goal, not only includes what you want to achieve, but also when you want to achieve them by. And understanding that each of us have a finite amount of time left on this planet, Sarah shared an exercise designed to help us understand just how little time each of us may have left. Some more, some less than others.

The calculation basically is to subtract your current age from 90 (which someone decided was the current average life expectancy). Multiply the result by 365, and you’re left with your ‘potential days left on earth’. Sarah did not expand on why kwWealth felt this number was important to understand, but it is my assumption that it was to remind us that our clocks are indeed all ticking, and that there is no time like the present to get started on our goals.

Millionaire Roadblocks

You can have results or you can have excuses. Not both.

Arnold Schwarzenegger

So what exactly keeps people from being millionaires? As it turns out, there’s a list, and it’s short:

They need to visit their capital

The don’t trust that the ‘wealth’ that is in their assets will hold its value.

The urge to be liquid

They think that ‘cash’ is real and everything else isn’t ‘as real’. So they have a constant need to convert assets to cash at some point.

Debt

The weight of debt causes them to want to pay it off, and without sufficient cash flow they see selling their assets as the only means to paying off debt. They don’t trust the asset to hold its value so they sell when they think the timing is right vs. ‘buying right’ and holding forever.

Lifestyle

The need / urge to live ‘high on the hog’ before their cash flow can support them in that way. This causes the need to liquidate regularly; to cash in future earning potential today so they can live high today.

People

They do not see people as an investment / asset.

Lack of Planning

They don’t have a written down wealth building plan that they trust. They ‘got’ rich instead of purposely building wealth so they actually don’t know how to duplicate what got them there in the first place.

Outpacing Earnings

They spend more money than they can earn or they spend all they make. Either way, it leaves them with no money available to invest.

They don’t learn

They don’t study money or the rules of investing.

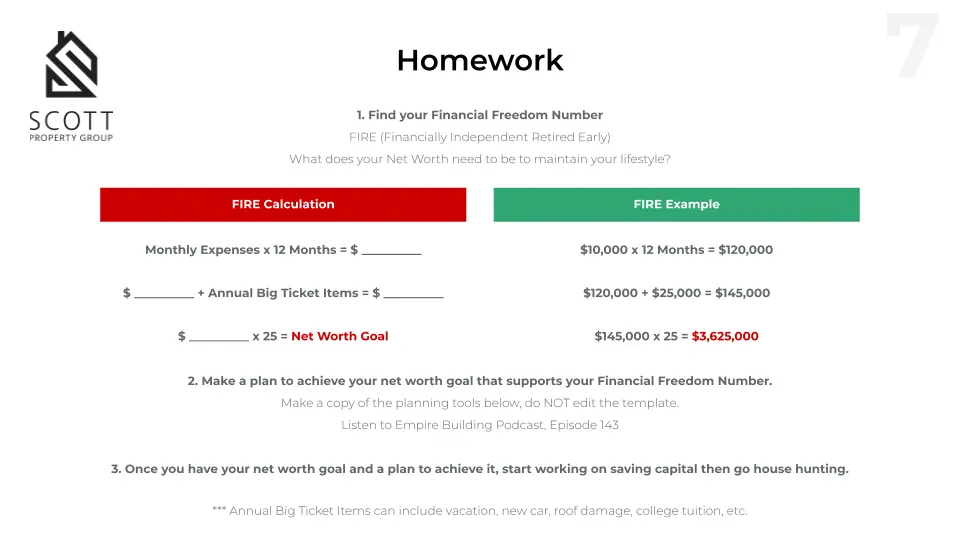

Finding your F.I.R.E.

Defined as Financially Independent Retired Early, F.I.R.E is a quick and simple calculation for determining exactly what your Net Worth needs to be to maintain your current or desired lifestyle. The calculation is simple:

- Add up all of your monthly expenses and multiply by 12 months.

- Add the result from Line 1 to any annual big ticket items.

- Multiply the result from Line 2 by 25 years.

The result is your Net Worth Goal, or your F.I.R.E. number. Once you have that number, develop a plan to achieve your net worth goal that supports your financial freedom number. And once you have your net worth goal and a plan to achieve it, start working on saving capital then go house hunting.

A couple of notes to remember here:

- Annual big ticket items can be anything, but think vacation, new car, roof damage, college tuition, and the like.

- Listen to the Empire Building Podcast, Episode 143.

So why multiply your annual living expenses by 25? The idea is that by having your Net Worth Goal in an investment vehicle that yields as little as a 4% ROI, you could transfer out your annual lifestyle budget needs without affecting your principle investment or decreasing its investment value.

Sarah shared a couple of investor tools with the class. You can download those here:

From Employee to Investor

Created by Robert Kiyosaki, The Cashflow Quadrant has become a mainstay with business owners and investors to picture their path to wealth. Most of us start our working years as an Employee, or working a Job. At this stage of our lives, we’re trading time for money and the only path for growth is to increase what we’re paid for that time.

From there, many people become Self Employed – they now OWN a JOB, but are still trading their time for money and are still every but as limited in their earning potential.

Next is the Business Owner, whose income is no longer dependent on the amount of active work he does, but rather that of his employees. He now MANAGES employees who work to create income for the Business Owner.

Lastly is the Investor. The Investor’s income is no longer dependent on the amount of active work he or she does. The Investor’s MONEY is now working to earn even more money. And this is the truth path to real wealth.

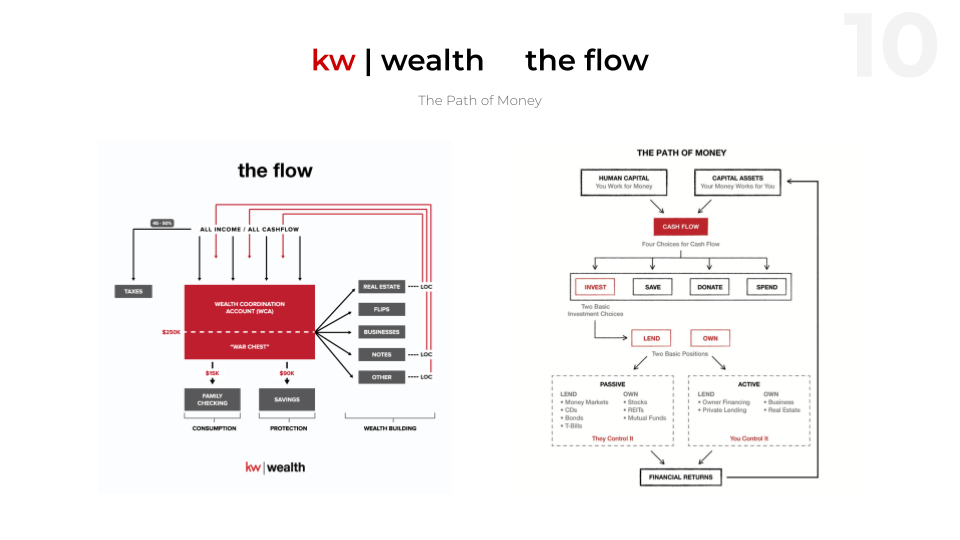

The Path of Money

Understanding how money moves through your business, your life, and your investments allows you to visualize where money needs to go to do its work. In kwWealth’s ‘the flow’, income is distributed first to tax reserves, then to a WarChest, then to a consumption account, a protection account, and into investments – whether that be real estate, businesses, notes, or other investments.

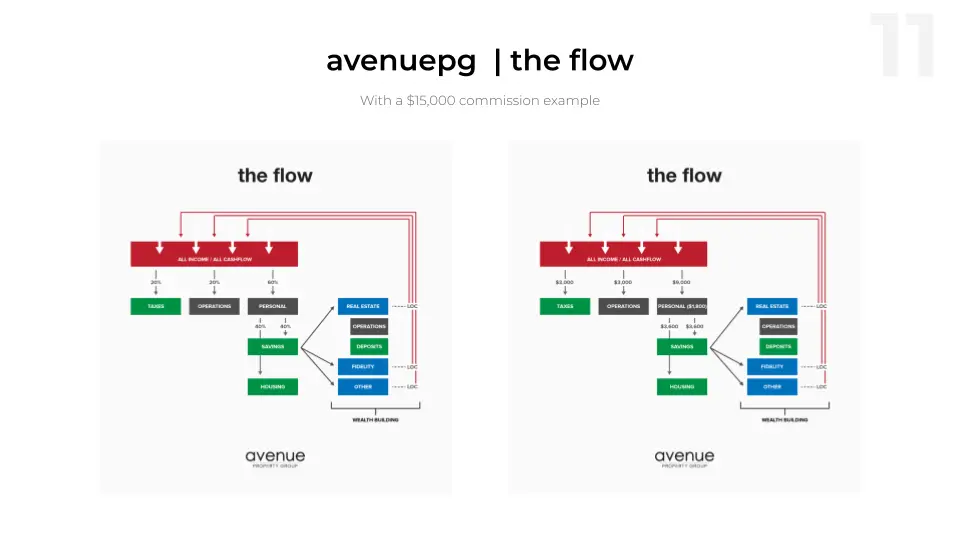

As an additional illustration, we’ve created our OWN version of ‘the flow’. But in ours, we’ve actually broken it down into physical bank accounts, so you can literally see where money is being moved. Green boxes represent Savings accounts, Grey boxes represent Checking accounts. In this illustration, Money comes in and is distributed among a Tax account, a business operations account, and personal checking account.

From there, a portion is moved to a Savings account (our WarChest from above) and into a Housing account (that pays all our Housing expenses for our personal residence). And finally the WarChest funds real estate investment, Fidelity investments, and other small investment projects.

Picking your Best Investments

Picking your best investments could be entire class of it’s own, but for the purposes of this class, we touched briefly on Short Term Rentals, Long Term Rentals, Flipping Homes (which I don’t really see as Investing) and Real Estate Syndications.

Long Term Rentals

Long Term Rentals are rental properties that are generally rented for 6 months to a year or more to one tenant. If done correctly, turnover is minimal, active work is minimal, and returns are made in both cash flow and property appreciation. Long term tenants are generally harder on a property than short term tenants simply because they’re living in the home every day.

Rents are market dependent, just as sales are. Appreciation can be forced through rehab, but there are limits and such upgrades can be costly. We’ve personally chosen to take this route, and do full rehabs on our rentals for three reasons:

- We’re improving the property value going in, so if a quick sale is needed down the road, it will be largely ready to put on the market quickly.

- Nicely upgraded and rehabbed homes can command higher rents.

- Higher rents generally attract a more qualified and (hopefully) better tenant.

Short Term Rentals

Short Term Rentals are vacation rentals, think AirBNB or VRBO. The income potential of these properties are generally considered greater than long term rentals, but make no mistake – STR’s are another BUSINESS. You’re now effectively a hotelier. And many municipalities are making it exceedingly more difficult to run these easily. Check out one of our previous masterminds that Candace Brawner did on Short Term Rentals.

Flipping

HGTV gave rise to the Flipping revolution. The basic premise is to buy low, do a nice rehab, and resell at top-of-market prices for a quick profit. And as much as I enjoy rehabbing properties, I’d prefer to hold to them long term – enjoying both cash flow and appreciation over the long haul.

Flipping can produce some really big pay days. But a lot of things can go wrong in the process as well. Minimizing those risks and overcoming obstacles needs to be a strong point in your character. Keep in mind that there is nothing passive about flipping. Once you stop, the income stops. And profits will be subject to capital gains taxes, so consult your CPA before getting started.

Candace also taught a class on Flipping – she’s done it all. That’s why we keep asking her back.

Syndications

Syndications are for the completely hands off investor. You’re basically buying into a fund. Your money is combined with other people’s money and the manager invests in generally much larger multi-family or commercial investments. You’re trading a large cash buy-in for monthly cash flow and a profit when the syndication sells the asset.

It’s a great option for investors that have no interest in managing rehabs, repairs, tenants and buying or selling. The biggest drawback is that you’re a limited partner – meaning you usually have no say in the asset being invested in, how it’s managed or how value is being added, and most importantly – you never actually own the asset yourself.

We have zero experience with Syndications, but have listened to books and podcasts about them. If you have an interest, we would encourage you to do the same.

All the rest…

Real estate is by no means the only options we have when investing, we just choose to focus on that asset class because largely – that’s what we all do. There are other traditional routes to take such as Stocks, Index Funds, ETF’s, and IRA’s as well as the more non-traditional growing Crypto market.

As small business owners and emerging investors – we always suggest you not keep all of your eggs in one basket. Look into the benefits of Index Funds, as well as Roth IRAs, SEP IRAs, Traditional IRAs and finally traditional brokerage accounts.

Stocks are sometimes considered high risk, high reward because of the singular nature of investing in one business. We’ve chosen to target index funds for our market investing simply because the idea of investing in a LOT of businesses in one fund feels safer while still offering great growth potential. If one business is down, there’s another to offset any losses.

Before you get involved in ANY stock or mutual fund investing, we highly recommend that you consult an investment counselor. This is well outside of our normal wheelhouse, so we’ve shared what we’ve learned along the way.