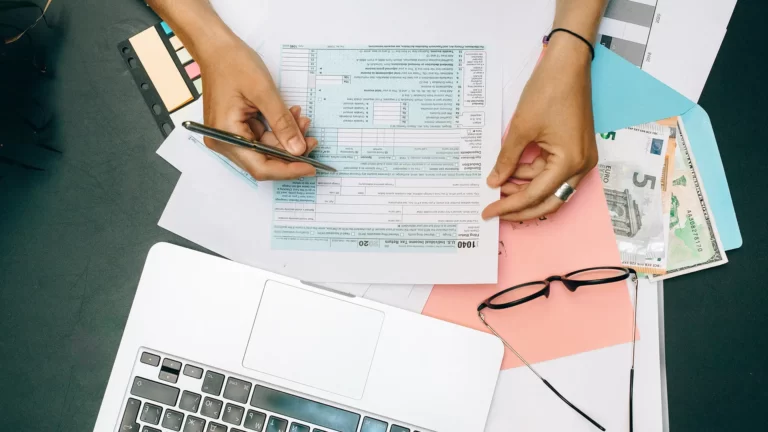

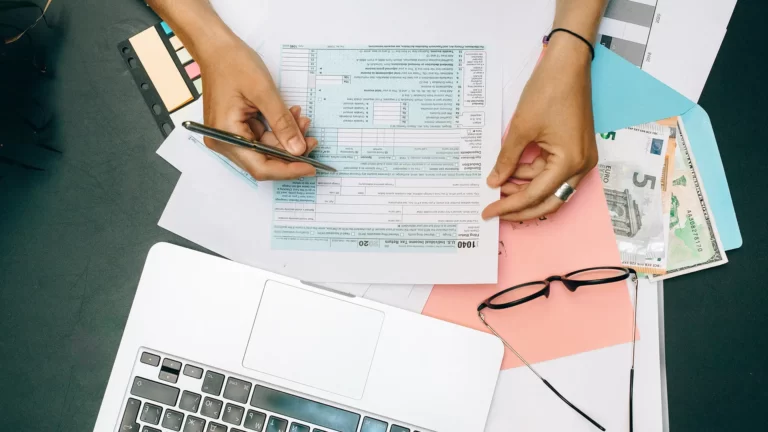

What Real Estate Investors Need to Know about Taxes brought to you by Joshua e. Howen and focuses on tax savings in real estate investing.

Investing in real estate is a numbers game. Let AMP Lending show you how to scale your portfolio by buying 10 properties in 10 months.

Join our rental property discussion panel as they share their strategies, wins, losses, and what they've learned building a rental portfolio.

Creating a diversified investment plan can help both agents and investors alike snap their real estate tunnel vision. Let's talk options!

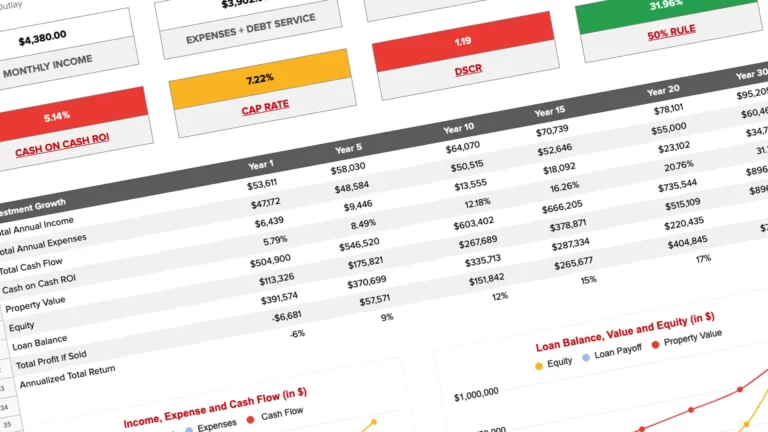

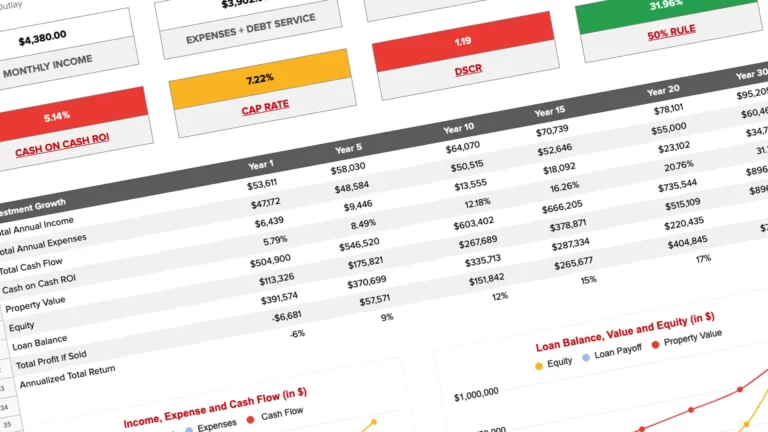

It would make a great investment. These six words make liars out of us every day. Join us to learn how to do a proper investment analysis.

Flipping real estate birthed the HGTV era. Our resident expert, Candace Brawner, shares her punch-list for turning a passion into profit.

Join Michael Robideau for a Q&A session on the best tax strategies that you can implement in your real estate investing business.

Savvy real estate investors have utilized the power of exchange, 1031 tax deferred exchanges for saving vast sums of capital gains taxes.

Short term rentals are earning investors larger returns on their money. Join Candace as she shares her wins & losses with these properties.